By Ricky Chang and David Crossey

KX has a broad list of products and solutions built on the time-series database platform kdb+ that capitalize on its high-performance capabilities when analyzing very large datasets.

KX for Surveillance is a robust platform widely used by financial institutions for monitoring trades for regulatory compliance. The Surveillance platform instantly detects known trading violations like layering, spoofing or marking the close. Customers can calibrate their parameters in real time to improve their detection quality and accuracy. The flexibility of the historical database and replay engine eases retrospective investigation for new types of fraudulent behavior and suspicious activity.

In this series, we take a look at what makes KX for Surveillance such a powerful tool for detecting market manipulation. This article discusses Front Running Alerts.

Front Running is an illegal trading practice under most jurisdictions and regulatory regimes. Under article 8 of the Market Abuse Regulation it is defined as follows:

“front running/pre-positioning – that is, a transaction for a person’s own benefit, on the basis of and ahead of an order (including an order relating to a bid) which he is to carry out with or for another (in respect of which information concerning the order is inside information), which takes advantage of the anticipated impact of the order on the market or auction clearing price”[1]

The definition of inside information is very broad; non-exhaustive examples include stock price-sensitive news announcements or mergers & acquisitions in equities markets or central bank announcements and economic reports for FX, Interest Rate Derivatives. Front running can occur in almost any asset class and product, such as shares, bonds, certificates of deposit, spot, forwards, swaps, options.

On November 13 2017, the New York State Department of Financial Services (DFS), announced that Credit Suisse AG had agreed to pay a fine of USD$135 million for front running of client orders, and other unlawful conduct which disadvantaged customers.

“The DFS investigation also found that front-running – trading ahead of known client orders – was encouraged by executives of eFX, Credit Suisse’s electronic trading platform. From at least April 2010 to June 2013, Credit Suisse employed an algorithm designed to front-run clients’ limit and stop-loss orders. Credit Suisse programmers designed the algorithm to predict the probability that a client’s limit or stop-loss order would be triggered. Credit Suisse traders would apparently enter the market with that information, knowing that the market might move in a specific direction if the stop-loss or limit order was triggered. From April 2010 through June 2013, Credit Suisse executed approximately 31,000 limit orders and 41,000 stop-loss orders that may have been a source of profit through front running. Additionally, because front-running can occur on orders that ultimately remain unfilled, Credit Suisse may have profited as well from front running many tens of thousands of additional client orders.”[2]

The Front Running solution provided in KX for Surveillance applies scenario alert rules to transactional data to identify entities (similar to the MAR definition of persons) which enter firm orders ahead of client orders, and other subsequent business logic rules to confirm that a front running scenario has occurred.

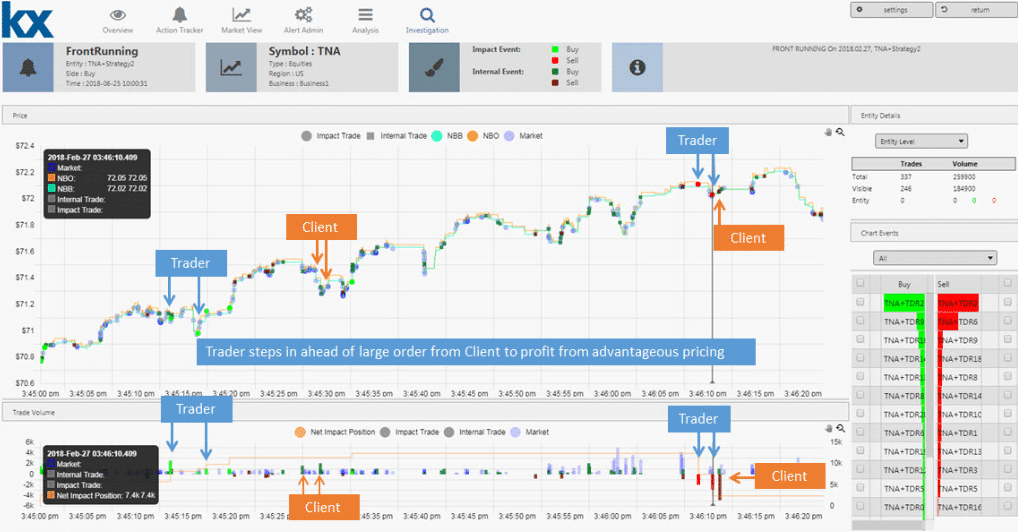

The KX for Surveillance dashboard below displays a trade price chart for NYSE Arca – Direxion Daily Small Cap Bull 3X ETF (TNA) on the 27th February 2018 between 3:45:00 pm and 3:46:20 pm, detailing that a Front Running scenario has been detected.

KX for Surveillance Dashboard Displays a Trade Price Chart for NYSE Arca – KX

The solution has identified Client and Trader (non-client) trades in the transactional data.

- On the Price graph, Trader buy trades were executed around 3:45:15 pm @ $71.1, ahead of the execution of Client buy trades around 3:45:30 pm @ $71.5. A similar sequence of events occured on the sell side around 3:46:10 pm @ $72.1.

- On the Trade Volume graph, trade volumes have been aggregated by time interval, to provide an indication of Trader/Client market impact across the trading period.

- On the Entity Details graph, trade volumes have been aggregated by side and entities, to provide an indication of which Trader/Client were dominant in trading.

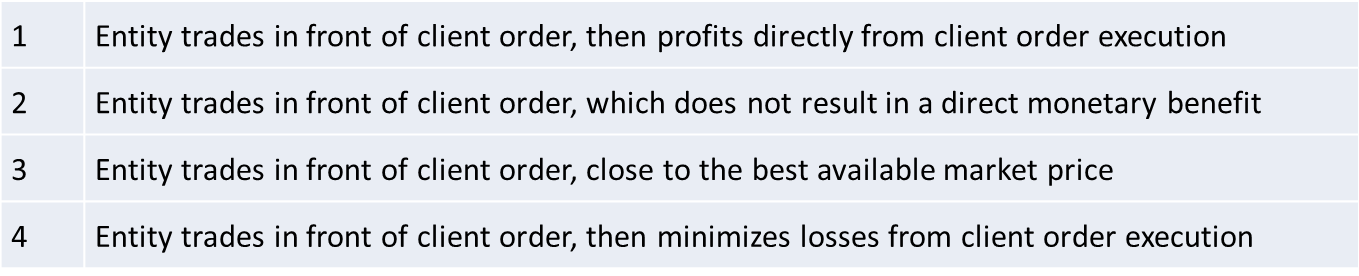

Front Running Variations

When an entity front runs a client order, the final outcome is subject to the prevailing market conditions. Regardless of outcome however, the intention is the same, which is to take advantage of the knowledge of the client’s order pricing and positioning, which is a clear breach of market regulations. This leads to four distinct scenarios that prevail in both rising and falling markets:

Entity Trades Front Running Variations – KX

We provide illustrations of two of these scenarios below:

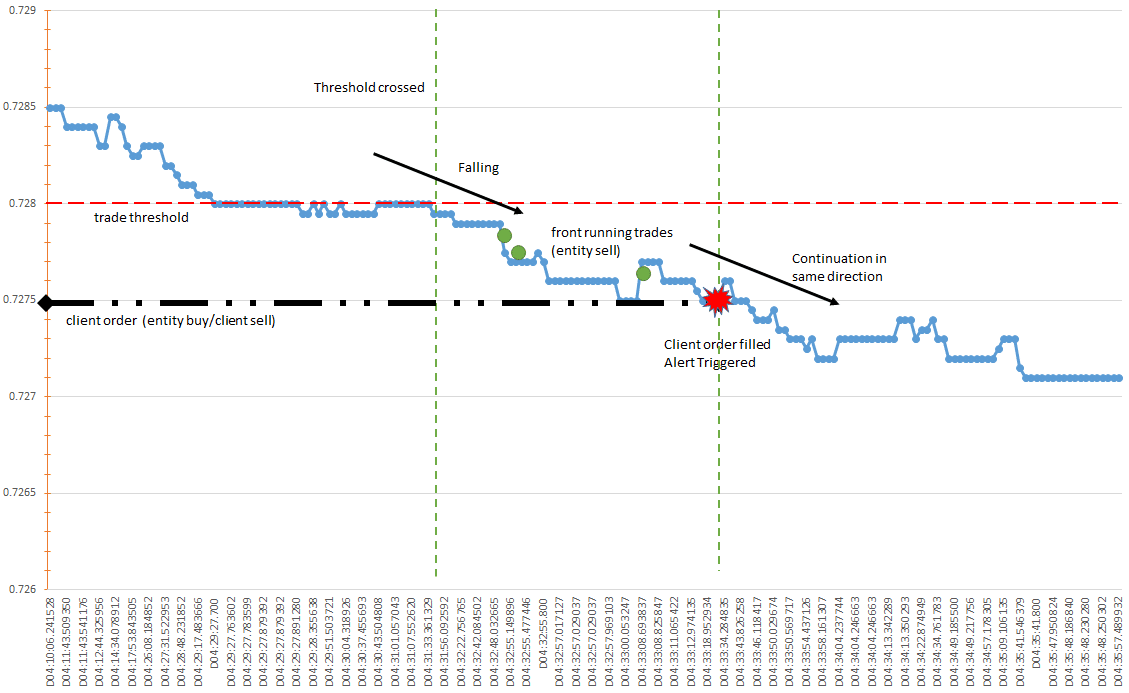

Falling Market Client Order Fill

In this example, a client order (entity buy/client sell) was entered @ 0.7275 in a falling market. With knowledge of the client order, the entity sold @ 0.72765 – 0.72785.

The market then continued in the same direction, which gave the entity an opportunity to fill the client order when the market price reached the client’s price, thus realizing a trading profit directly as a result of filling the client order.

Instead of reverting, had the market reverted in the opposite direction, the entity would appear to have sold into a falling market. Scenario #2 would have occurred, and although the entity did not realize any apparent benefit, it is still a valid Front Running scenario.

KX Dashboard for Surveillance Falling Market Client Order Fill – KX

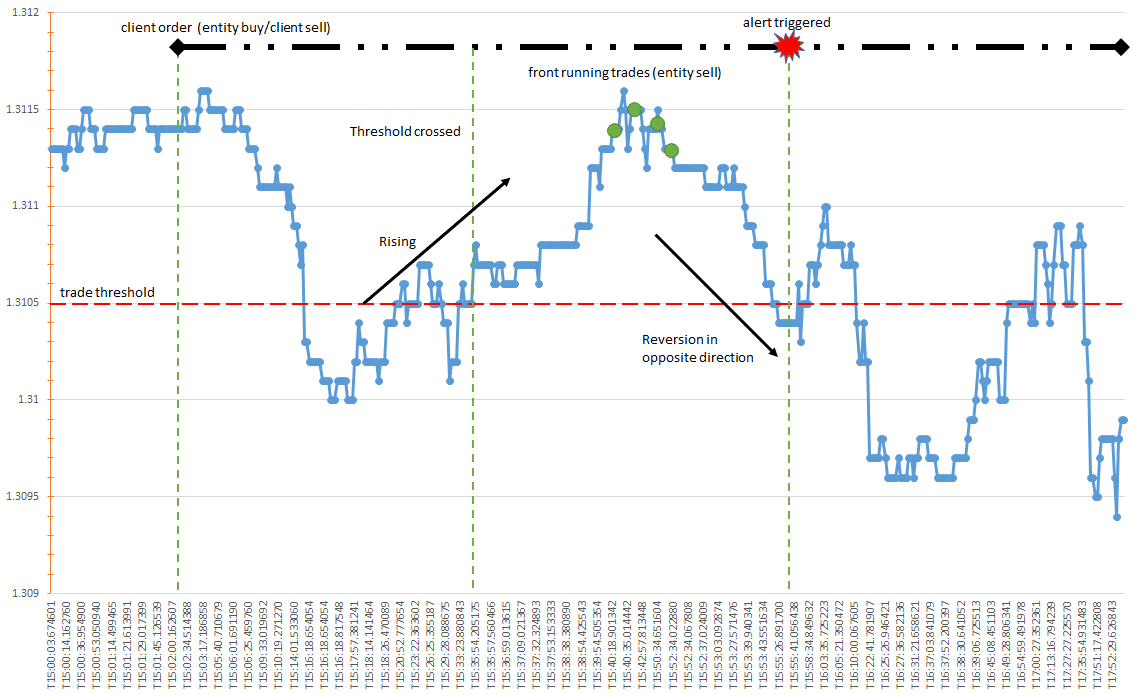

Rising Market Reversion

In this example, a client order (entity buy/client sell) was entered @ 1.3118 in a rising market. With knowledge of the client order, the entity sold @ 1.3113 – 1.3115, which is close to the best market price in the given timeframe.

The market then reverted in the opposite direction, which gave the entity an opportunity to buy back into the market at a lower price, thus realizing a potential trading profit.

Instead of reverting, had the market continued in the same direction, the entity would have to fill the client order when the market price reached the client’s price. Scenario #4 would have occurred, which gave the entity an opportunity to minimize its losses by filling the client order.

KX Dashboard for Surveillance Rising Market Reversion – KX

The KX for Surveillance solution enables detection and investigation of Front Running scenarios in both real-time and historical data. It can simultaneously capture all relevant orders, trades and market data (trades), and process the newly captured data for potential Front Running scenarios. If critical data dependencies have not been satisfied, processing can be deferred or rescheduled until they are.

KX Dashboards enables users to gain high level overview of top suspects, to detailed investigation of individual alerts with visualization tools (graphs, line/volumes charts) that interleave all transactional data to recreate a view of the market.

The solution allows business users to tweak Alert Threshold parameters without impacting system performance.

The Front Running scenarios described in this post can be further customized by:

- Adding asset class / product / trading system-specific implementation logic;

- Integrating auxiliary supporting information, such as emails and chats;

- Extending data search over a longer historical period to detect a prolonged pattern of abusive behavior

[1] “MAR 1.3 Insider dealing – FCA Handbook.” https://www.handbook.fca.org.uk/handbook/MAR/1/3.html. Accessed 7 Jan. 2019.

[2] “Press Release – November 13, 2017: DFS Fines Credit Suisse AG ….” Accessed 7 Jan. 2019.

For more information on KX for Surveillance and its functionality please click on the links below.